Buying property in Italy – what is worth knowing?

Basics of buying property in Italy – what is worth knowing?

Buying property abroad is a dream for many people – especially when we’re talking about sunny Italy, where life slows down and the landscapes are breathtaking. Italian homes and apartments tempt not only with their beauty but also… with their price. But what exactly is the process of buying property in Italy like? Can Poles buy a house or apartment there? What formalities must be met? Read our guide, which will dispel your doubts and introduce you to the Italian real estate market.

Can a Polish citizen buy real estate in Italy?

Yes – and without any restrictions! Both Poland and Italy are members of the European Economic Area, which guarantees the free movement of capital. This means that Poles can purchase real estate in Italy under the same conditions as Italian citizens. No special permits or approvals are required.

What are the formalities when buying a house or apartment in Italy?

The process of purchasing real estate in Italy is similar to that known in Poland. However, there are some differences and details that should be taken into account.

The key stages are:

- Selection of real estate and analysis of the legal status of the property

- Analysis of the technical condition of the property

- Obtaining an Italian Tax Identification Number – Codice Fiscale

- Making a formal offer to the seller (Proposta) and conclusion of a preliminary contract (Compromesso)

- Conclusion of the final contract (Rogito) at the notary’s

Technical and legal verification – why is it so important?

In Italy, the legal and factual consistency of a property is crucial. The seller is responsible for ensuring consistency and must declare this in the notarial deed. However, for your own safety, it’s worth investing in the services of a qualified technician who will verify the documentation and the actual condition of the property.

Our experience shows that discrepancies are common, and any post-purchase issues can fall on the new owner’s shoulders. The cost of such verification is typically several hundred euros – and the peace of mind and security are priceless.

Taxes – what do you need to know?

Taxes can be a significant expense when buying property in Italy. However, it all depends on whether you are buying the house as a P rima casa, or Seconda casa.

PRIMA CASA (principal residence) – purchase of real estate as prima casa involves the obligation to transfer tax residence to Italy and live there for at least 183 days a year. However, in return, you can benefit from tax relief, on the basis of which the buyer is entitled to:

– reduction of registration tax to 2% (from 9%) – the tax is calculated on the cadastral value of the property

– exemption from the annual IMU property tax – this does not apply to luxury properties

SECONDA CASA (second property, e.g. holiday or investment) – purchase of real estate as seconda casa does not require residing there for most of the year or changing residence, but in such a case:

– registration tax is 9% of the cadastral value

– annual IMU property tax applies

So if you are planning to move to Italy, purchase as Prima casa can bring significant savings, but the vast majority of foreign clients decide to purchase real estate as Seconda casa – They are required to pay higher taxes when purchasing real estate, but they do not face any additional obligations related to changing their place of residence.

It is worth noting that if you are considering moving to Italy, it is not necessary to be an Italian resident at the time of purchase – according to the regulations, the buyer can declare to the notary during the notarial deed that he wants to take advantage of the tax relief available to real estate buyers as Prima casa. In this case, the buyer has 18 months from the date of purchase to move to Italy.

Is real estate in Italy more expensive than in Poland?

This is one of the most frequently asked questions – and the answer may surprise you. Data from both countries shows that average property prices in Italy are lower than in Poland.

- Poland (2024): approx. 2 500 – 3 000 euro/m²

- Italy (2024): approx. 1 500 – 2 000 euro/m²

(Source: NBP qarterly information Q2024, monthly commentary Polish Economic Institute, Report OMI Agenzia delle Entrate, idealista.it)

It’s worth noting that the presented ranges include both asking and transaction prices (typically, selling prices fall at the lower end of the range, while asking prices fall at the upper end). Data for Italy comes from a report prepared by the Italian Tax Office in collaboration with the National Banking Association, ensuring broad access to detailed information from across the market, ensuring high accuracy of the presented prices. In Poland, accurate and reliable data is more difficult to obtain, and available statistics often focus primarily on larger cities, which can distort average prices nationwide – so it’s worth considering a slightly wider margin of interpretation.

Real estate prices in Italy in 2024

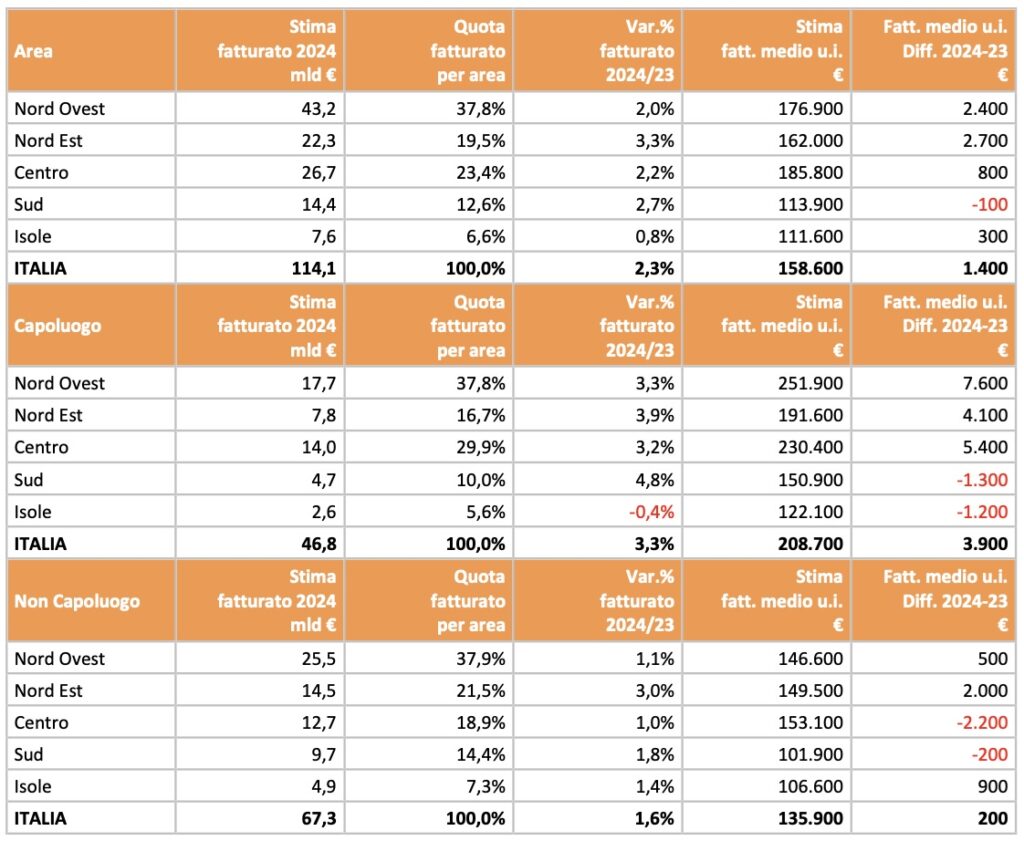

Italy is very diverse in every respect, including real estate prices. The basic division is between the more expensive north and the cheaper south, but real estate prices also vary depending on the size of the cities in which they are located. The average real estate prices in Italy in 2024 are presented in the table below (see Table 1 – column: Stima fatt. medio u.i. €):

- Italy – 158 600 €

- Northwestern Italy – 176 900 €

- Northeastern Italy – 162 000 €

- Central Italy – 185 800 €

- Southern Italy – 113 900 €

- Italian islands – 111 600 €

- largest Italian cities (regional capitals) – 208 700 €

- other Italian towns – 135 900 €

Table 1: Estimated total and average property values and annual change by region and town and city

Source: Raport OMI – Agenzia delle Entrate

Current situation on the real estate market in Italy (2024)

According to the latest report by the Real Estate Market Observatory:

- In 2024, the market entered the growth phase again (+ 1,3%) – number of transactions amounted to over 700 thousand

- The average property sold in 2024 had an area of 106 m²

- The most frequently sold apartments in 2024 were those with an area of 50–85 m²

- The average purchase price in 2024 was €158,600 – in the south, prices often did not exceed €100,000 (e.g. Calabria – €74,300), and in the north they were close to €200,000 (e.g. Lombardy – €194,200)

- About 40% of residential real estate transactions in 2024 involved a mortgage loan

- The average mortgage installment is 677 euros, and the down payment is 22.8%.

Why is it worth buying property in Italy?

Besides stunning architecture, excellent cuisine, and a vibrant lifestyle, Italy also offers attractive real estate prices, a stable market and cheaper mortgages than in Poland. After years of falling prices and a subsequent prolonged stagnation caused by the 2008 global financial crisis, the Italian real estate market has recently entered a recovery phase, making it a good time to buy your dream property while still relatively affordable.

Planning to buy property in Italy? Contact us!

In La Mia Casa For years, we’ve been helping our clients realize their Italian dreams. From finding the perfect home, through technical and legal verification, to signing the notarial deed. We’re with you every step of the way!

Don’t miss out on our next blog posts! In the following articles, we’ll provide a detailed analysis of our latest report analyzing the Italian real estate market. We’ll also showcase the most beautiful corners of our unique Prosecco Hills region.

Follow us and stay tuned for new publications!